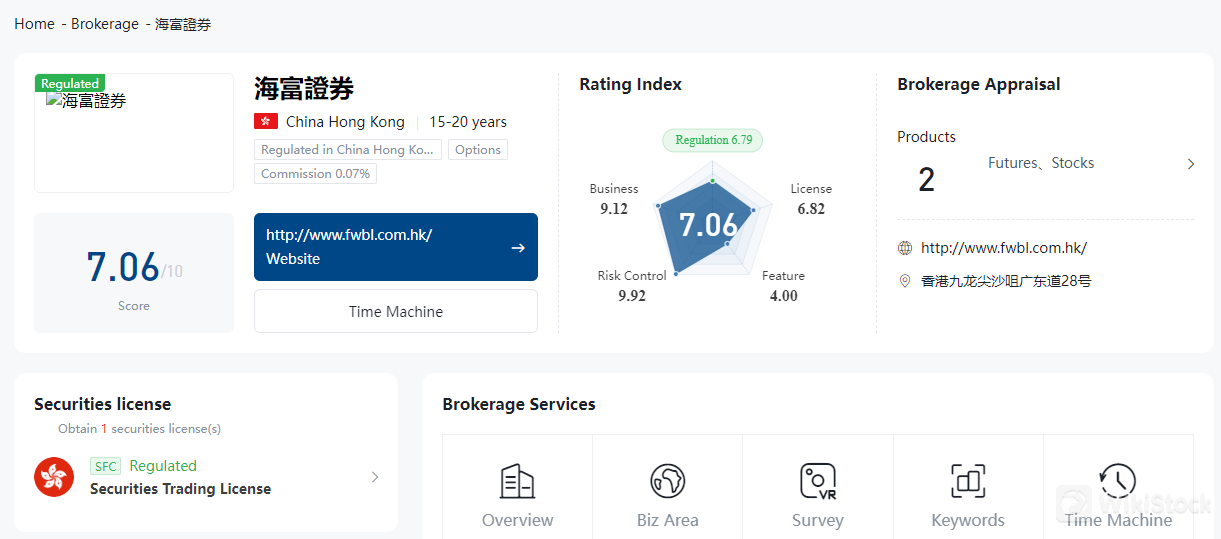

Score

海富證券

http://www.fwbl.com.hk/

Website

Rating Index

Brokerage Appraisal

Products

2

Futures、Stocks

Securities license

Obtain 1 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 01385

Brokerage Information

More

Company Name

Fairwin Broking Limited

Abbreviation

海富證券

Platform registered country and region

Company address

Company website

http://www.fwbl.com.hk/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

| Fairwin Broking Limited |  |

| WikiStock Rating | ⭐⭐⭐ |

| Fees | 0.07% for online trading (HKD 50 minimum); 0.25% for phone trading (HKD 100 minimum) |

| Account Fees | Various fees for transactions, custody, and services |

| Mutual Funds Offered | Yes |

| App/Platform | Available on Android, iPhone, and Windows |

What is Fairwin Broking Limited?

Fairwin Broking Limited is a brokerage firm regulated by the Securities and Futures Commission (SFC) of Hong Kong, offering low-cost trading options and a user-friendly trading app available on Android, iPhone, and Windows platforms. The company provides diverse trading options, including Hong Kong stocks, futures, and Renminbi currency futures, along with comprehensive educational resources for investors. However, there is a lack of detailed information on insurance coverage for client funds and customer service availability could be improved.

Pros and Cons of Fairwin Broking Limited

Fairwin Broking Limited offers a robust trading platform regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring high regulatory standards and investor protection. The platform provides diverse trading options, including Hong Kong stocks, global futures, and Renminbi currency futures. It also includes a comprehensive education section to empower investors with in-depth knowledge. However, there are some areas where it could improve, such as providing more transparency on insurance coverage for client funds and enhancing customer service based on user feedback.

| Pros | Cons |

| Regulated by the Securities and Futures Commission (SFC) of Hong Kong | Lack of detailed information on insurance coverage for client funds |

| Diverse trading options | Potentially high fees for certain transactions and services |

| Comprehensive educational resources | Limited promotional offers and incentives for new users |

| User-friendly trading platform | Inactivity policy that closes accounts if no funds are deposited within 90 days |

| Advanced encryption and security measures to protect client data |

Is Fairwin Broking Limited safe?

Fairwin Broking Limited appears to be a relatively safe option for trading, considering three critical dimensions: regulations, funds safety, and safety measures.

Regulations

Fairwin Broking Limited is regulated by the Securities and Futures Commission (SFC) of Hong Kong. Being regulated by the SFC ensures that the company adheres to strict regulatory standards, providing a degree of security and oversight that helps protect investors. The SFCs rigorous regulatory framework includes regular audits, compliance checks, and requirements for maintaining adequate capital reserves, which contribute to the overall safety of client investments.

Funds Safety

Regarding the safety of client funds, it is essential to know whether Fairwin Broking Limited offers any form of insurance for account funds. While specific details about insurance coverage for client accounts are not explicitly provided, reputable brokers typically segregate client funds from their own operational funds. This segregation ensures that client funds are not used for the brokers operational activities, which adds a layer of protection. To get precise information about insurance coverage and the exact amount insured, it is recommended to contact Fairwin Broking Limited directly.

Safety Measures

Fairwin Broking Limited employs several safety measures to protect clients' funds and personal information. These measures typically include advanced encryption technologies to secure data transmission and storage. Encryption helps prevent unauthorized access to sensitive financial information, ensuring that clients personal and financial data are kept safe from cyber threats. Additionally, brokers often implement robust account security measures, such as two-factor authentication (2FA), to further protect against unauthorized access and potential data breaches.

What are securities to trade with Fairwin Broking Limited?

Fairwin Broking Limited offers various securities for trading, focusing on the Hong Kong Stock Exchange.

Hong Kong stocks refer to shares listed on the Hong Kong Stock Exchange, traded in Hong Kong dollars. This market was established in eighteen sixty-six with the first exchange founded in eighteen ninety-one. It is globally recognized for its strict regulatory framework and T+0 trading rule. By the end of twenty seventeen, the market capitalization reached thirty-four trillion Hong Kong dollars, with an average daily turnover of eighty-eight point two billion Hong Kong dollars. There are two thousand one hundred eighteen listed companies, with a total fundraising amount of five hundred seventy-nine point nine billion Hong Kong dollars from new listings.

Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect are collaborative schemes between the Hong Kong, Shanghai, and Shenzhen stock exchanges. These schemes allow international and mainland Chinese investors to trade securities in each others markets through local exchanges. Launched in November two thousand fourteen and August two thousand sixteen respectively, they operate under local market regulations with cross-border trading conducted in RMB. They maintain the original market rules and settlement systems.

Callable Bull Bear Contracts are structured investment products offering leverage by allowing investors to undertake interest costs in exchange for leverage effects without paying the full purchase price of the underlying asset. They have a mandatory call mechanism, meaning if the underlying asset's price hits the call price, the contract is immediately called. There are two types: bull contracts for those optimistic about the asset, and bear contracts for those pessimistic. Bull Bear Contracts can be further categorized into N and R classes, with N class having no residual value upon a call, while R class may retain some value depending on the closing price of the underlying asset.

Fairwin Broking Limited also provides access to global futures, including index futures like the Mini Dow Jones Index, Mini Standard and Poor's Index, Mini Nasdaq One Hundred Index, and others. These contracts are traded electronically with cash settlement. Additionally, they offer interest rate futures such as five-year and ten-year US Treasury bonds, and commodity futures including agricultural products like corn, soybeans, wheat, and others. They also provide access to metal futures like gold, silver, platinum, and palladium, as well as energy futures like crude oil, heating oil, and natural gas. All these futures contracts are traded electronically with specified trading hours and contract months, ensuring a wide range of options for investors.

The platform also offers Renminbi currency futures, specifically the US dollar against Renminbi futures traded in Hong Kong. These contracts involve a specified contract amount and minimum price fluctuation, with trading conducted in both regular and extended hours. The settlement involves the seller delivering the specified US dollar amount and the buyer paying the equivalent in Renminbi based on the final settlement price.

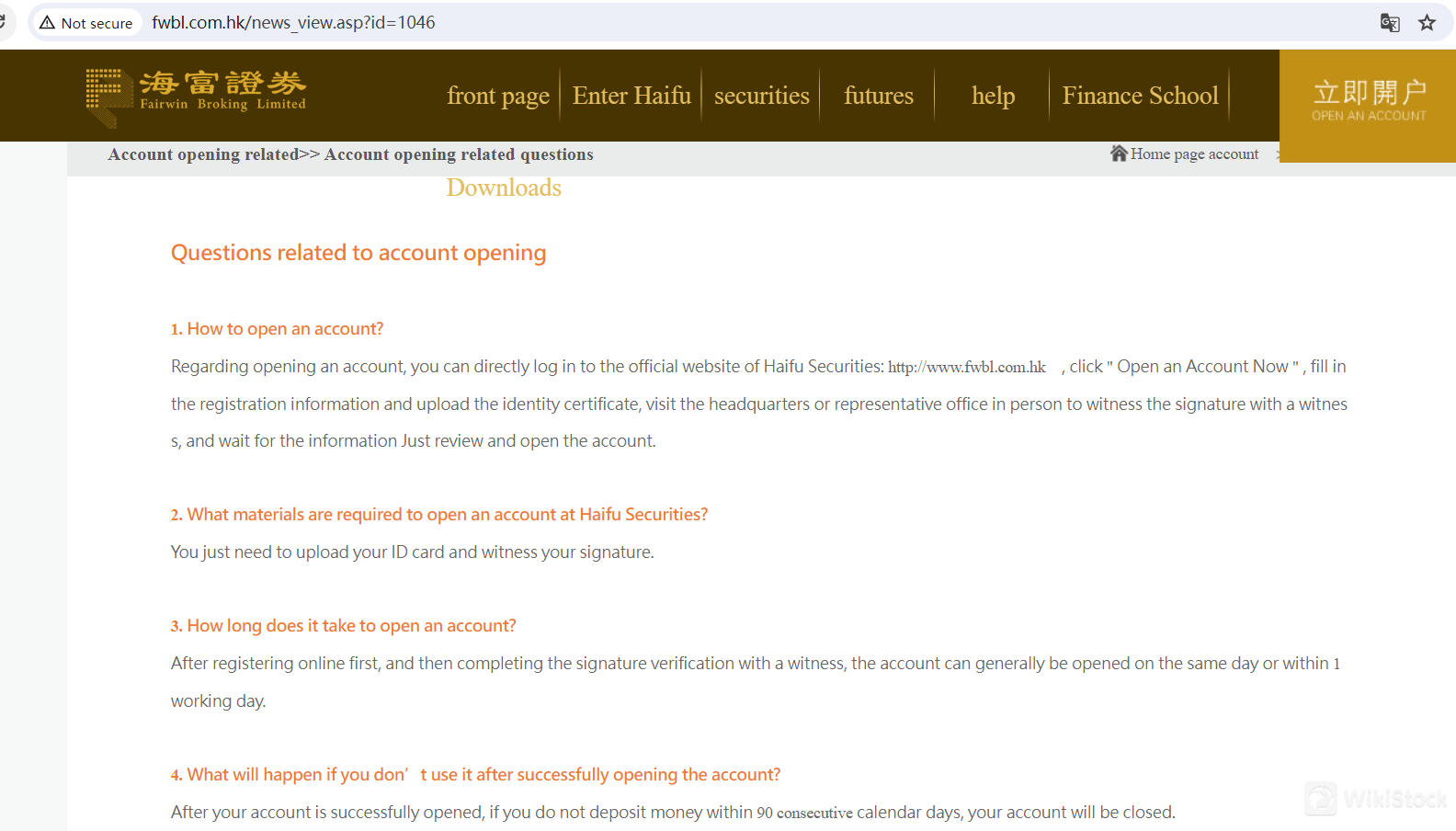

Fairwin Broking Limited Account Opening Process

To open an account with Fairwin Broking Limited, you can follow these steps:

Visit the Fairwin Broking Limited Website: Go to the Fairwin Broking Limited website at https://www.fwbl.com.hk.

Click on “Open an Account Now”: Locate and click on the “Open an Account Now” button.

Fill in Registration Information: Complete the registration form by providing the required information.

Upload Identification Proof: Upload your identification proof, such as your ID card.

Witness Signature: Visit the headquarters or a representative office to have your signature witnessed by an authorized person.

Wait for Approval: After submitting your information and completing the witness signature, wait for the review process. The account is typically activated on the same day or within one business day.

Identification Proof: Upload your ID card.

Witness Signature: Complete the witness signature process.

Required Materials for Account Opening

Account Activation Time

Once you have registered online and completed the witness signature, the account can generally be activated on the same day or within one business day.

Inactivity Policy

If your account is successfully opened but no funds are deposited within ninety calendar days, the account will be closed.

Confirmation of Account Opening

You will receive an email notification once your account is fully activated. Alternatively, you can check your account status by logging into the Fairwin Broking Limited website, navigating to “Personal Center,” then “My Account,” and finally “Account Status.”

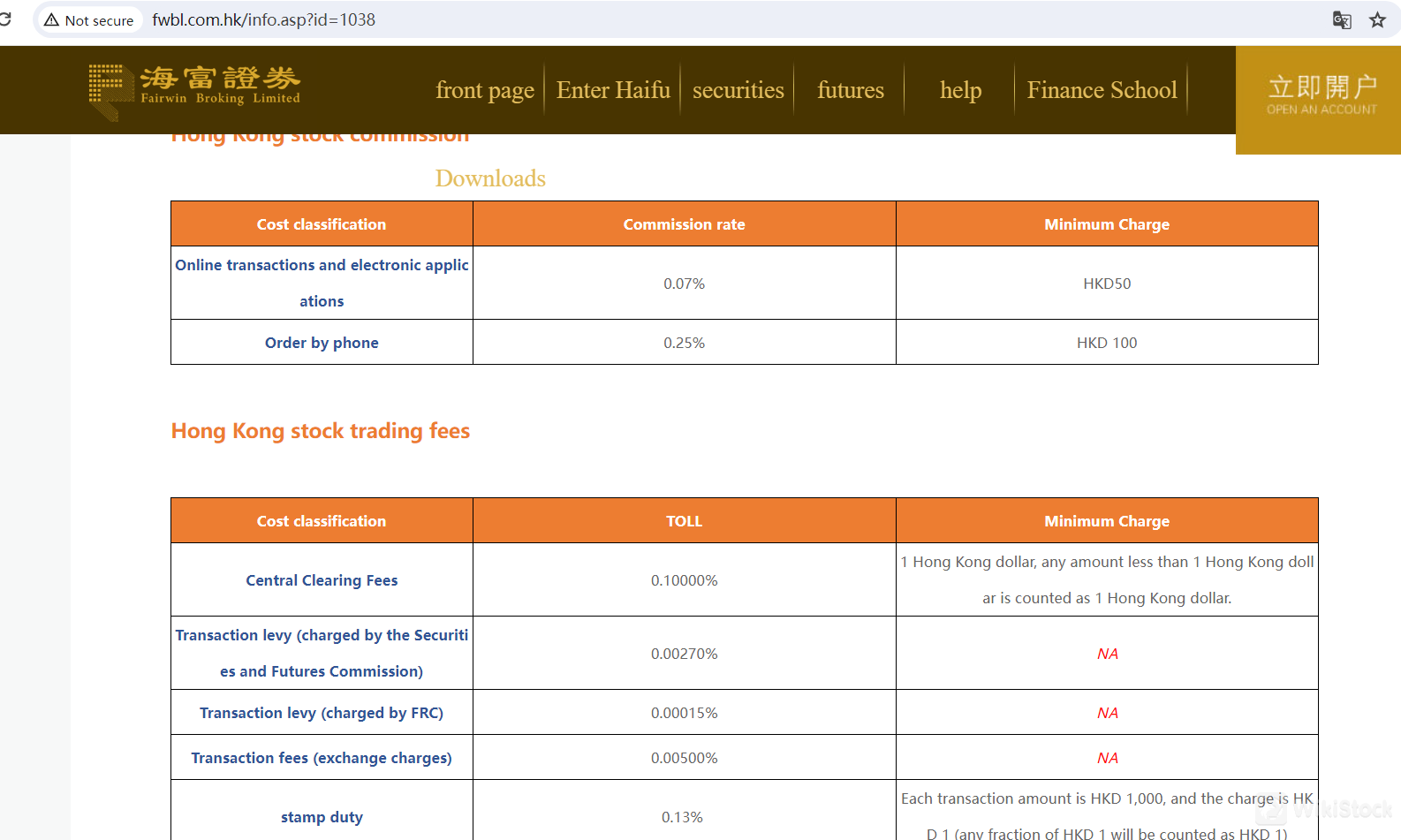

Fairwin Broking Limited Fees Review

Fairwin Broking Limited offers a detailed fee structure for trading various securities and futures.

For Hong Kong stock transactions, commissions for online trading and electronic applications are set at 0.07% with a minimum charge of HKD 50. Telephone orders incur a commission rate of 0.25% with a minimum charge of HKD 100. Additional fees for Hong Kong stock transactions include a central clearing fee of 0.1%, a transaction levy by the Securities and Futures Commission at 0.0027%, and a Financial Reporting Council levy at 0.00015%. There is also a transaction fee charged by the Stock Exchange of Hong Kong at 0.005% and a stamp duty of 0.13%.

For the Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect schemes, commissions for online trading are negotiable with a minimum charge of RMB 50, while telephone orders have a commission rate of 0.25% with a minimum charge of RMB 100. Transaction fees include a stamp duty of 0.1% on sales and a portfolio fee of 0.008%, calculated daily and charged monthly.

Fairwin Broking Limited also imposes various other fees, such as HKD 100 per transaction for subscribing to new stocks through the Central Clearing System, and charges for electronic fund transfers and local cash transfers. Custodial fees, reissuing transaction or monthly statements, and mailing fees are also applicable, although existing customers are exempt from the latter.

For futures trading, fees vary by contract and exchange. For Hong Kong index futures, handling fees range from HKD 15 to HKD 25 depending on the specific index. For US index futures, handling fees are generally USD 8 per contract. Similar fees apply to US forex, interest rate, agricultural, energy, and metal futures, with most contracts incurring a handling fee of USD 8. European index futures, such as the DAX and mini DAX, have handling fees of EUR 8 per contract.

This comprehensive fee structure ensures transparency and allows clients to understand the costs associated with their trading activities.

Fairwin Broking Limited App Review

Fairwin Broking Limited offers a versatile trading platform accessible on multiple devices, ensuring convenience and flexibility for its users. The platform is available for download on Android, iPhone, and Windows, providing a seamless trading experience across various operating systems. Users can engage in real-time trading, manage their portfolios, and access comprehensive market data and analysis tools. The platform's user-friendly interface and robust security features ensure efficient and secure transactions, catering to the diverse needs of both novice and experienced traders.

Research and Eduation

Fairwin Broking Limited offers a comprehensive Finance School section designed to educate and empower investors with in-depth knowledge and research on various financial instruments. This section includes detailed modules on Hong Kong stocks, providing insights into the workings of the Hong Kong Stock Exchange, trading strategies, and market trends. The Callable Bull Bear Contracts module explains the features, risks, and benefits of these leveraged products, helping investors understand how to use them effectively. Additionally, the Futures module covers various aspects of futures trading, including contract specifications, trading techniques, and risk management strategies. This educational resource aims to enhance investors' understanding and decision-making capabilities in the complex financial markets.

Customer Service

Fairwin Broking Limited offers comprehensive customer support to address the needs and concerns of its clients. They provide multiple contact options, including a consultation phone line at 852-25227007 for direct inquiries. Customers can leave suggestions or feedback through an online form where they can provide their title, content, contact person's name, phone number, QQ, email, and address.

Conclusion

Fairwin Broking Limited is a Hong Kong-based brokerage firm regulated by the Securities and Futures Commission (SFC). It offers low-cost trading options and a user-friendly app available on Android, iPhone, and Windows platforms. The company provides diverse trading services, including Hong Kong stocks, global futures, and mutual funds, with comprehensive educational resources for investors. However, specific details about insurance coverage for client funds and margin interest rates are not specified, and there is room for improvement in customer service availability.

FAQs

Is Fairwin Broking Limited safe to trade?

Yes, Fairwin Broking Limited is considered relatively safe to trade. It is regulated by the Securities and Futures Commission (SFC) of Hong Kong, ensuring it adheres to strict regulatory standards, providing a degree of security and oversight that helps protect investors.

Is Fairwin Broking Limited a good platform for beginners?

Fairwin Broking Limited can be a good platform for beginners due to its user-friendly app available on Android, iPhone, and Windows. Additionally, the platform offers comprehensive educational resources through its Finance School section, which helps new investors understand various financial instruments and trading strategies.

Is Fairwin Broking Limited legit?

Yes, Fairwin Broking Limited is a legitimate brokerage firm. It operates under the regulation of the Securities and Futures Commission (SFC) of Hong Kong, ensuring it follows all necessary legal and regulatory requirements.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

More than 20 year(s)

Commission Rate

0.07%

Regulated Countries

1

Products

Futures、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

匯誠證券

Score

金山金融

Score

Monmonkey

Score

Joy Rich

Score

Midas Securities

Score

中富證券

Score

CAPITAL Global Management Limited

Score

Soliton

Score

Gear Financial

Score

TENGARD

Score