Score

木村証券

https://www.kimurasec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

C

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

Japan NSE

木村証券株式会社

Brokerage Information

More

Company Name

KIMURA SECURITIES CO.,LTD.

Abbreviation

木村証券

Platform registered country and region

Company address

Company website

https://www.kimurasec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.11%

Margin Trading

YES

Regulated Countries

1

Products

5

| Kimura Securities |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Founded | 1944 |

| Registered Region | Japan |

| Regulatory Status | FSA |

| Products | Domestic stocks, foreign stocks, government bonds for individuals, investment trusts, non-life insurance |

| Commissions | Domestic listed stocks: 0.11-1.265% + fixed rate depending on trading volume, min 2750 yen |

| Listed securities with new stock subscription rights: 0.165-1.1% + fixed rate depending on trading volume | |

| Foreign listed stocks: 0.33-11% + fixed rate depending on trading volume | |

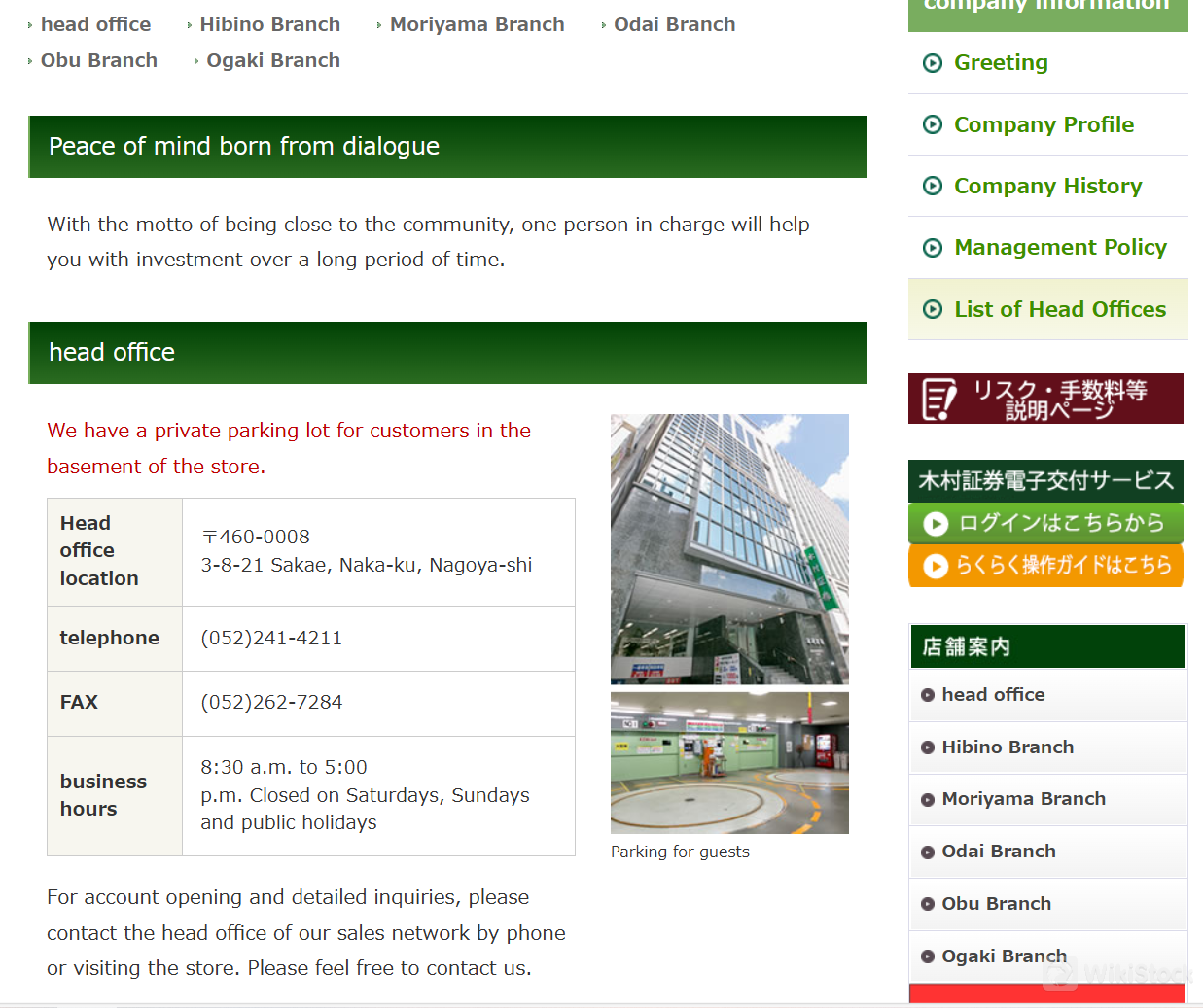

| Customer Service | Head office: 〒460-0008, 3-8-21 Sakae, Naka-ku, Nagoya-shi |

| TEL: (052)241-4211; fax: (052)262-7284 |

Kimura Securities Information

Established in 1944, with roots tracing back to 1893, Kimura Securities is a prominent financial institution operating across Japan, with headquarters in Nagoya and 5 branch offices.

Specializing in a diverse array of investment products, Kimura Securities offers domestic and foreign stocks, government bonds for individuals, investment trusts, and non-life insurance. The firm is known for its transparent fee structures, which include commissions ranging from 0.11% to 11% depending on the type of security and trading volume.

Regulated by Japan's Financial Services Agency (FSA) under license number Director-General of the Tokai Finance Bureau (Kinsho) No. 6, Kimura Securities adheres to rigorous standards of integrity and credibility.

For more detailed information, you can visit their official website: https://www.kimurasec.co.jp/ or contact their customer service directly.

Pros & Cons

| Pros | Cons |

| Regulated by FSA | Limited Customer Service Channels |

| Diverse Investment Products | |

| Established History |

- Regulatory Oversight: Regulated by the Japan Financial Services Agency (FSA), ensuring adherence to strict financial standards and investor protection.

- Diverse Investment Products: Kimura Securities offers a wide range of investment options including domestic and foreign stocks, government bonds for individuals, investment trusts, and non-life insurance.

- Established History: With roots dating back to 1893 and formal establishment in 1944, Kimura Securities brings extensive experience and credibility in the financial services industry. Cons:

- Limited Customer Service Channels: Though the company enable clients to contact them via physical address, phone and fax, more immediate and mordern options such as live chat, email or social media platforms are not available, limiting client options.

- Super Jump (Maturity Return Fire Insurance): One-time payment fire insurance with full coverage and maturity returns.

- Home Assist (Comprehensive Home Insurance): Fire insurance for residential buildings with customizable coverage options.

- Earthquake Insurance: Protection against earthquake-related damages to buildings and household contents, including volcanic eruptions and tsunamis.

- Head office: 〒460-0008, 3-8-21 Sakae, Naka-ku, Nagoya-shi.

- Hibino Branch: 〒456-0072, Shiratori Building 1st floor, 2-16 Kawanami-cho, Atsuta-ku, Nagoya City

- Moriyama Branch: 〒 463-0042, 13-14, nohagi-cho, moriyama ward, Nagoya city.

- Odai Branch: 〒 452-0815, 68 yasuji-cho, nishi ward, Nagoya city

- Obu Branch: 〒 474-0036, 30 tsukimi-cho, ofu city

- Ogaki Branch: 〒 503-0852, Ogaki city kasumoricho 2-74.

- Is Kimura Securities regulated by any financial authority?

- Yes, Kimura Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA), with license no. Director-General of the Tokai Finance Bureau (Kinsho) No. 6.

- What types of products does Kimura Securities provide?

- Domestic stocks, foreign stocks, government bonds for individuals, investment trusts and non-life insurance.

- Is Kimura Securities suitable for beginners?

- Yes, the company is well regulated by FSA and offers transparent fee structures which is friendly to beginners.

- What are the fee structures for Kimura Securities' services?

- Kimura Securities provides clear and transparent fee structures. For example, domestic listed stocks have commissions ranging from 0.11-1.265% plus a fixed rate, with a minimum fee of 2750 yen.

- What non-life insurance products does Kimura Securities offer?

- Super Jump (Maturity Return Fire Insurance), Home Assist (Comprehensive Home Insurance), and Earthquake Insurance.

Is It Safe?

Regulation:

Kimura Securities operates under the regulatory oversight of the Japan Financial Services Agency (FSA) with license no. Director-General of the Tokai Finance Bureau (Kinsho) No. 6, showcasing its dedication to maintaining the utmost standards in financial operations. This regulatory adherence underscores Kimura Securities's commitment to integrity and credibility in its services.

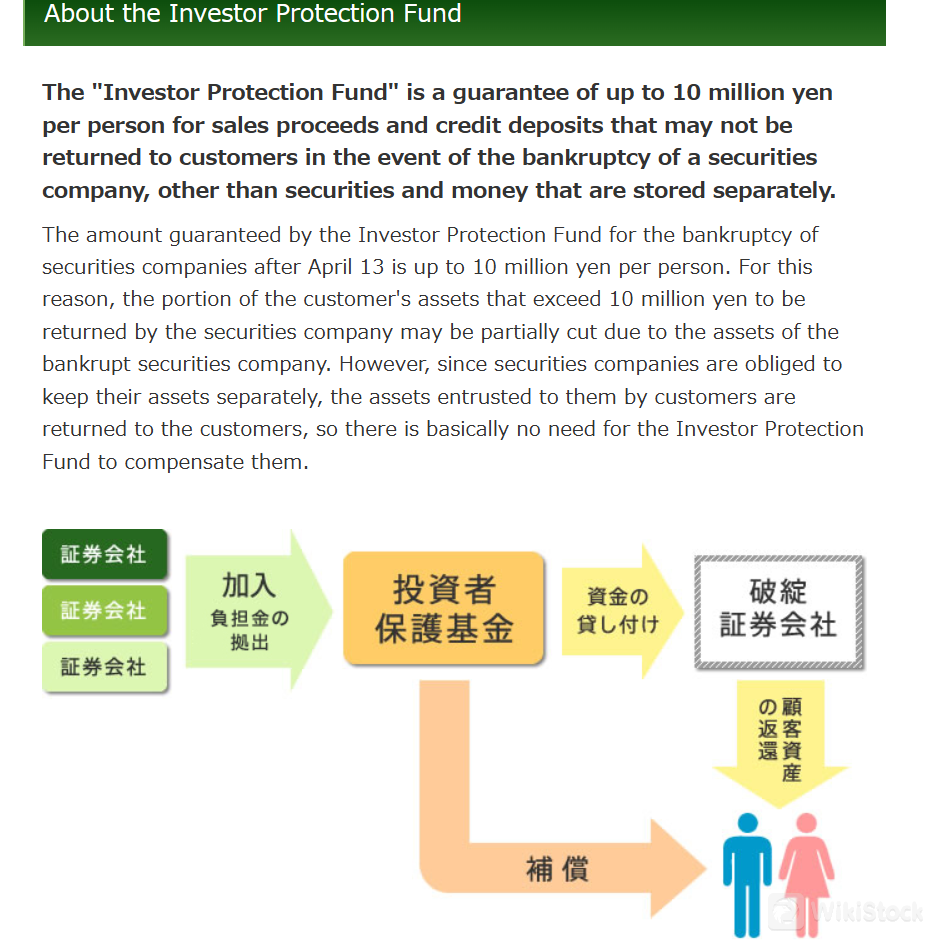

Fund Safety:

Kimura Securities prioritizes the safety of client funds through the Investor Protection Fund, which guarantees up to 10 million yen per person for sales proceeds and credit deposits if the company faces bankruptcy.

Safety Measures:

Kimura Securities ensures the safety and security of client assets through a segregated management system. This system mandates that all cash and securities entrusted to the company by customers are managed separately from the company's own assets.

What are Securities to Trade with Kimura Securities?

Kimura Securities offers a comprehensive suite of financial products across several categories:

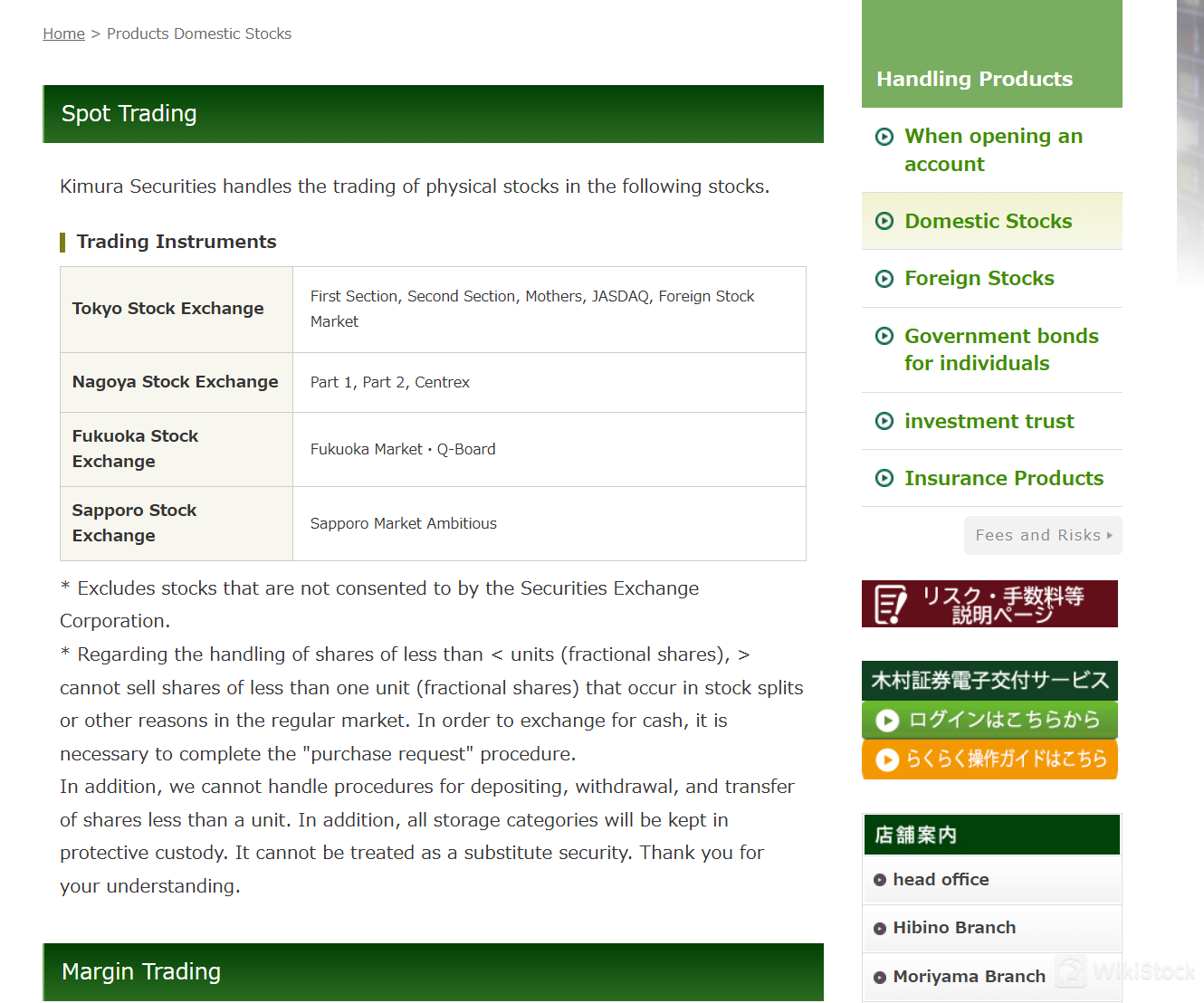

Domestic Stocks: Kimura Securities provides access to Japan's domestic stock market, allowing investors to trade and invest in a variety of listed companies by spot and margin trading.

Foreign Stocks: For those interested in global investment opportunities, Kimura Securities offers access to foreign stocks. Clients can diversify their portfolios by investing in the US and China markets, benefiting from potential growth and market opportunities abroad.

Government Bonds for Individuals: Kimura Securities enables individuals to invest in government bonds, providing a stable and secure investment option. These bonds are backed by the Japanese government, offering reliable returns and contributing to a balanced investment strategy.

Investment Trusts: Kimura Securities offers investment trusts that pool funds from multiple investors to invest in diversified portfolios of securities. This allows clients to access professionally managed investment opportunities across various asset classes, tailored to different risk appetites and financial goals.

Non-Life Insurance: In addition to investment products, Kimura Securities provides non-life insurance solutions. Examples as below:

Fees Review

Kimura Securities applies transparent fee structures for each product, below is the details:

Domestic Listed Stocks| Transaction Amount | Commission Fee |

| Up to 1 million yen | 1.26500% of transaction amount |

| 1 million yen to 3 million yen | 0.90750% + 3,575 yen |

| 3 million yen to 5 million yen | 0.89650% + 3,905 yen |

| 5 million yen to 10 million yen | 0.69300% + 14,080 yen |

| 10 million yen to 20 million yen | 0.55000% + 28,380 yen |

| 20 million yen to 30 million yen | 0.49500% + 39,380 yen |

| 30 million yen to 50 million yen | 0.30250% + 97,130 yen |

| 50 million yen to 180 million yen | 248,380 yen flat fee |

| Over 180 million yen | 0.11000% + 50,380 yen |

| Minimum fee 2,750 yen applies if less than 1.26500% | |

| Transaction Amount | Commission Fee |

| Up to 1 million yen | 1.10000% of transaction amount |

| 1 million yen to 5 million yen | 0.99000% + 1,100 yen |

| 5 million yen to 10 million yen | 0.77000% + 12,100 yen |

| 10 million yen to 30 million yen | 0.60500% + 28,600 yen |

| 30 million yen to 50 million yen | 0.44000% + 78,100 yen |

| 50 million yen to 100 million yen | 0.27500% + 160,600 yen |

| 100 million yen to 1 billion yen | 0.22000% + 215,600 yen |

| Over 1 billion yen | 0.16500% + 765,600 yen |

| Transaction Amount | Commission Fee |

| Up to 55,000 yen | 11.000% of transaction amount |

| 55,000 yen to 300,000 yen | 6,050 yen flat fee |

| 300,000 yen to 1 million yen | 1.100% + 2,750 yen |

| 1 million yen to 3 million yen | 0.990% + 3,850 yen |

| 3 million yen to 5 million yen | 0.880% + 7,150 yen |

| 5 million yen to 10 million yen | 0.770% + 12,650 yen |

| 10 million yen to 30 million yen | 0.660% + 23,650 yen |

| 30 million yen to 50 million yen | 0.550% + 56,650 yen |

| 50 million yen to 100 million yen | 0.440% + 111,650 yen |

| Over 100 million yen | 0.330% + 221,650 yen |

Note: Transaction amounts are converted to yen equivalents based on local market values, with additional fees for stamp duties and other charges applied as per local regulations.

For most up-to-date and detailed information of all its products, clients are encouraged to visit the Kimura Securities website at https://www.kimurasec.co.jp/fee.php.

Customer Service

Kimura Securities provides customer support via physical address, phone and fax, ensuring clients can reach out for assistance and inquiries.

Telephone: (052)241-4211; FAX: (052)262-7284.

Telephone: (052)682-3911; FAX: (052)682-3915.

Telephone: (052)791-6341; FAX: (052)793-1914.

Telephone: (052)502-6511; FAX: (052)504-2750.

Telephone: (0562)46-7715; FAX: (0562)46-7718.

Telephone: (0584)74-1171; FAX: (0584)74-1175.

Business hours: 8:30 a.m. to 5:00 p.m. Closed on Saturdays, Sundays and public holidays.

Conclusion

Kimura Securities, established in 1944 and regulated by the Japan Financial Services Agency (FSA) under license number Director-General of the Tokai Finance Bureau (Kinsho) No. 6, offers a comprehensive range of investment products, including domestic stocks, foreign stocks, government bonds for individuals, investment trusts, and non-life insurance. With transparent fee structures and a regulated status, Kimura Securities remains a trustworthy entity to investors, upholding high standards of regulatory compliance, integrity, and client service in the financial sector.

Frequently Asked Questions (FAQs)

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Others

Registered region

Japan

Years in Business

More than 20 year(s)

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Download App

Review

No ratings

Recommended Brokerage FirmsMore

SMBC

Score

今村証券

Score

Nissan Securities

Score

水戸証券

Score

東洋証券株式会社

Score

豊証券株式会社

Score

Kyokuto Securities

Score

あかつき証券

Score

ちばぎん証券

Score

Money Partners

Score