Score

広田証券

https://www.hirota-sec.co.jp/

Website

Rating Index

Brokerage Appraisal

Influence

B

Influence Index NO.1

Japan

JapanProducts

5

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Securities license

Obtain 1 securities license(s)

FSARegulated

JapanSecurities Trading License

Brokerage Information

More

Company Name

広田証券株式会社

Abbreviation

広田証券

Platform registered country and region

Company address

Company website

https://www.hirota-sec.co.jp/Check whenever you want

WikiStock APP

Brokerage Services

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Commission Rate

0.2%

Margin Trading

YES

Regulated Countries

1

Products

5

| Hirota Securities |  |

| WikiStock Rating | ⭐️⭐️⭐️⭐️ |

| Fees | vary depending on the type of security and the transaction amount |

| Account Fees | No account opening fee |

| App/Platform | No app |

Hirota Securities Infomation

Hirota Securities distinguishes itself as a comprehensive financial services provider in Japan, offering a range of personalized investment solutions and financial planning expertise. The firm focuses on asset management, encompassing stocks, bonds, and mutual funds.

Pros & Cons of Hirota Securities

| Pros | Cons |

| Personalized Service | No Online Platform |

| Formal Regulation | Limited Educational Resources |

| High Fees | |

| Limited Geographic Reach |

Personalized Service: Hirota Securities prioritizes in-person consultations with specialists who offer asset management strategies.

FormalRegulation: Being registered with the Japan Financial Services Agency (FSA) provides some assurance that they are legitimate and operate under regulatory oversight.

Cons:No Online Platform: There's no online platform for trading or account management. This is a drawback for those who prefer a digital investment experience.

Limited Educational Resources: The focus is on in-person consultations, with a lack of readily available online resources like research reports, articles, or educational tools. This might limit options for self-directed learning.

High Fees: The commission structure is on the higher side compared to some competitors.

Limited Geographic Reach: Their branch network is concentrated in Japan, particularly the Kyoto and Shiga region.

Is Hirota Securities Safe?

Hirota Securities is registered with the Japan Financial Services Agency (FSA) under License No.: Kinki Finance Bureau Director (Securities) No. 33. This indicates that Hirota Securities is authorized to conduct securities business in Japan and is subject to the FSA's regulations and oversight.

The FSA is an independent government agency responsible for regulating the financial services industry in Japan, including securities, banking, and insurance. Its objectives include maintaining the stability of the financial system, protecting investors, and promoting fair and efficient markets.

What are Securities to Trade with Hirota Securities?

The information provided suggests Hirota Securities offers more than just traditional securities trading.

- Asset Management: They focus on personalized investment planning and portfolio management. This involve recommending a variety of securities suitable for customers' goals and risk tolerance, including stocks, bonds, or mutual funds.

- Investment Education: They acknowledge the inherent risks of investing and aim to educate clients, particularly first-time investors, to build confidence in navigating the financial markets.

- Retirement Planning: Hirota Securities offers guidance on using stock investments to supplement pension and secure financial future after retirement.

- Estate Planning: Hirota Securities assists with strategies like inheritance and gifting, involving asset allocation with various securities to ensure a smooth transfer of wealth to customers' loved ones.

- Online Pre-Application: Hirota Securities has an online account opening form that allows clients to submit basic information electronically. This expedites the in-person application process.

- In-Person Application: Customers can either visit a Hirota Securities branch or have a staff member visit them to complete the account opening process. This would involve filling out a physical application form and discussing suitable account options with a representative.

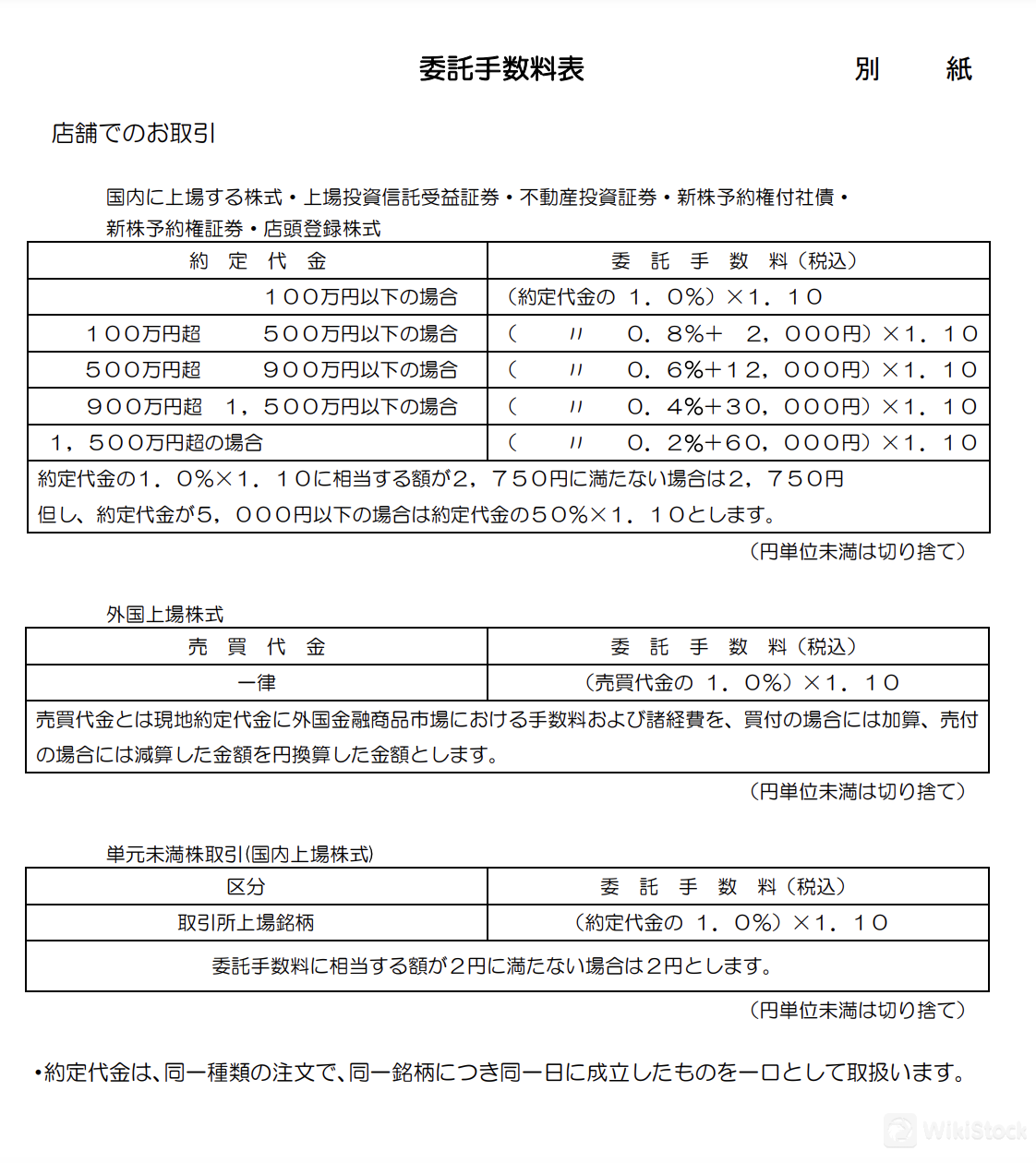

- Stocks, Investment Trusts, Real Estate Investment Securities, New Share Subscription Warrants, New Share Subscription Warrants, OTC Stocks:

- 2,750 yen if the calculated commission fee is less than 2,750 yen

- 50% of the transaction amount (inclusive tax) if the transaction amount is 5,000 yen or less

- 1.0% (inclusive tax) of the transaction amount for transactions up to 1 million yen

- 0.8% (inclusive tax) of the transaction amount + 2,000 yen for transactions over 1 million yen and up to 5 million yen

- 0.6% (inclusive tax) of the transaction amount + 12,000 yen for transactions over 5 million yen and up to 9 million yen

- 0.4% (inclusive tax) of the transaction amount + 30,000 yen for transactions over 9 million yen and up to 15 million yen

- 0.2% (inclusive tax) of the transaction amount + 60,000 yen for transactions over 15 million yen

- Minimum Commission Fee:

- 2,750 yen if the calculated commission fee is less than 2,750 yen

- 50% of the transaction amount (inclusive tax) if the transaction amount is 5,000 yen or less

- Stocks: 1.0% (inclusive tax) of the transaction amount

- Free Consultations: Their primary educational tool is free consultations at branches. Specialists can address questions and concerns, offering guidance on asset management strategies that suit customers' individual needs and goals.

- FAQ: Hirota Securities has a Frequently Asked Questions (FAQ) section on their website that could answer basic questions about accounts, transactions, and other general topics.

Hirota Securities Accounts

The process for opening an account highlights two options:

Hirota Securities Fees Review

Hirota Securities' brokerage fees vary depending on the type of security and the transaction amount.

Domestic SecuritiesResearch & Education

Hirota Securities prioritizes personalized guidance over in-depth research and educational resources.

Customer Service

Hirota Securities prioritizes phone and email consultations for customer service. They have branches in several locations across Japan, including Osaka (2 branches), Tokyo (1 branch), Hyogo (4 branches), and Shiga (3 branches). After filling out the form online, customers can press the send button to send the email.| Address | Tel | Fax | |

| Head Office | 〒541-0041 大阪府大阪市中央区北浜1丁目1番24号 | 06-6201-1181 | 06-6229-2752 |

| Ibaraki Branch | 〒567-0829 大阪府茨木市双葉町8番22号 | 072-632-1181 | 072-632-1552 |

| Tokyo Branch | 〒103-0025 東京都中央区日本橋茅場町1丁目7番3号 | 03-3667-1181 | 03-3667-0573 |

| Kobe Branch | 〒651-0087 神戸市中央区御幸通6丁目1番20号 GEETEX ASCENT BLDG 8階 | 078-261-1181 | 078-232-1060 |

| Sumoto Branch | 〒656-0026 兵庫県洲本市栄町2丁目3番35号 | 0799-24-1181(洲本支店・南あわじ出張所共通) | 0799-24-1188(洲本支店) |

| 南あわじ出張所 〒656-0461 兵庫県南あわじ市市円行寺150 | 0799-42-5501(南あわじ出張所) | ||

| Kawanishi Branch | 〒666-0016 兵庫県川西市中央町8番8号 アメニティ川西ビル5階 | 072-756-1181 | 072-756-1186 |

| Woody Town Sales Office | 〒669-1322 兵庫県三田市すずかけ台2丁目3番1号 | 079-562-1181 | 079-565-7816 |

| Yokaichi Branch | 〒527-0012 滋賀県東近江市八日市本町2番18号 | 0748-22-1212 | 0748-23-1212 |

| Kusatsu Branch | 〒525-0032 滋賀県草津市大路2丁目1番53号 | 077-565-1212 | 077-564-5657 |

| Otsu Sales Office | 〒520-0043 滋賀県大津市中央2丁目2番18号 | 077-526-1313 | 077-525-5174 |

Conclusion

Hirota Securities presents a compelling option for Japanese investors seeking a personalized approach to wealth management. Their focus on in-person consultations with specialists and potential guidance for various needs, from first-time investing to retirement planning, can be valuable. Being registered with the FSA adds a layer of legitimacy. However, the lack of a clear online platform and limited educational resources beyond consultations are drawbacks for tech-savvy investors or those seeking independent research. Additionally, higher fees compared to competitors require careful consideration.

FAQs

Is Hirota Securities safe to trade?

Yes, being registered with Japan's Financial Services Agency (FSA) offers some assurance.

Is Hirota Securities a good platform for beginners?

Yes. Hirota Securities offers consultations with specialists who can explain investment basics. Beginners can also get guidance at no cost.

Is Hirota Securities good for investing/retirement?

Hirota Securities offers consultations for retirement planning, but higher fees and limited online resources require consideration.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

Japan

Years in Business

More than 20 year(s)

Products

Securities Lending Fully Paid、Bonds & Fixed Income、Futures、Options、Stocks

Review

No ratings

Recommended Brokerage FirmsMore

IBKR

Score

Mizuho Securities

Score

Webull

Score

PhillipCapital

Score

NOMURA

Score

OANDA

Score

IG

Score

Daiwa

Score

Saxo

Score

Standard Chartered

Score