Score

清科國際

https://www.qkintl.com/

Website

Rating Index

Brokerage Appraisal

Influence

D

Influence Index NO.1

China Taiwan

China TaiwanProducts

6

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Securities license

Obtain 2 securities license(s)

SFCRegulated

China Hong Kong Securities Trading License

SFCRegulated

China Hong Kong Fund Management License

Global Seats

![]() Owns 1 seat(s)

Owns 1 seat(s)

China Hong Kong HKEX

Seat No. 02170

Brokerage Information

More

Company Name

Zero2IPO International Holdings Limited

Abbreviation

清科國際

Platform registered country and region

Company address

Company website

https://www.qkintl.com/Check whenever you want

WikiStock APP

Brokerage Services

Business analysis

清科國際 Earnings Calendar

Currency: CNY

Cycle

FY2023 Annual Report

2026/02/15

Revenue(YoY)

238.46M

+8.08%

EPS(YoY)

0.05

-27.55%

清科國際 Earnings Estimates

Currency: CNY

- DateCycleEPS/Estimated

- 2021/03/302020/FY0.120/0

Internet Gene

Gene Index

APP Rating

Features of Brokerages

Trading Fee

$1.3

Platform Service Fee

HK$10

Commission Rate

0.15%

Minimum Deposit

$1,500

Funding Rate

1.25%

New Stock Trading

Yes

Margin Trading

YES

Regulated Countries

1

Note: The information provided in this review may be subject to change due to the constant updating of the company's services and policies. In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

In this review, if there is a conflict between the image and the text content, the text content should prevail. However, we recommend that you open the official website for further consultation.

| Zero2IPO International |  |

| WikiStock Rating | ⭐⭐⭐⭐ |

| Account Minimum | Not Mentioned |

| Commission Fees (Hong Kong Market) | Commissions for trading on electronic systems: 0.15% minimum $100 |

| Commission on telephone trading: 0.25% minimum $100 | |

| Commissions for trading in the grey market electronic system: 0.15% minimum $100 | |

| Grey market commissions are paid for telephone trading: 0.25% minimum $100 | |

| Platform Usage Fees (Hong Kong Market) | HK$10 per order (waived during the promotion period until further notice) |

| Trading Market Fees (Hong Kong Market) | Transaction fees: 0.00565% * Transaction amount (minimum HK$0.01 per transaction) |

| Central Clearing Fee: 0.002% * Transaction amount (min. HK$2, max. HK$100) | |

| Transaction levy: 0.0027%* Transaction amount (min. HK$0.01) | |

| stamp duty: 0.10%* Transaction amount (rounded up to the nearest dollar) (this fee is not charged when trading warrants and CBBCs)) | |

| AFRC Transaction Levy: 0.00015% * Transaction Amount (Min. HK$0.01 (Effective from 1 Jan 2022)) | |

| Deposit & withdrawal of Funds (Hong Kong Market) | Free (Hong Kong local banks only) |

| App/Platform | Zero2IPO International Holdings Limited App |

| Promotions | Not mentioned |

What is Zero2IPO International?

Zero2IPO International Holdings Limited is a prominent financial services provider based in Hong Kong, regulated by the Securities and Futures Commission (SFC). The company specializes in a wide array of financial services, including securities trading, investment banking, asset management, and structured finance. Through its state-of-the-art trading platform, accessible via the Zero2IPO app on iPhone, Android, and open API, clients can trade Hong Kong and U.S. stocks with real-time quotations.

Pros & Cons

| Pros | Cons |

| Regulated by SFC | Limited Fee-Free Transactions |

| Comprehensive Service Offering | Higher Telephone Trading Fees |

| Real-Time Quotations | Platform Usage Fee |

| Mobile and API Access | |

| Robust Customer Support |

Pros

Regulated by SFC: Zero2IPO is regulated by the Securities and Futures Commission of Hong Kong (SFC), ensuring compliance with stringent standards for investor protection and market integrity.

Comprehensive Service Offering: The company provides a wide range of services, including securities trading, investment banking, asset management, and structured finance, catering to diverse financial needs.

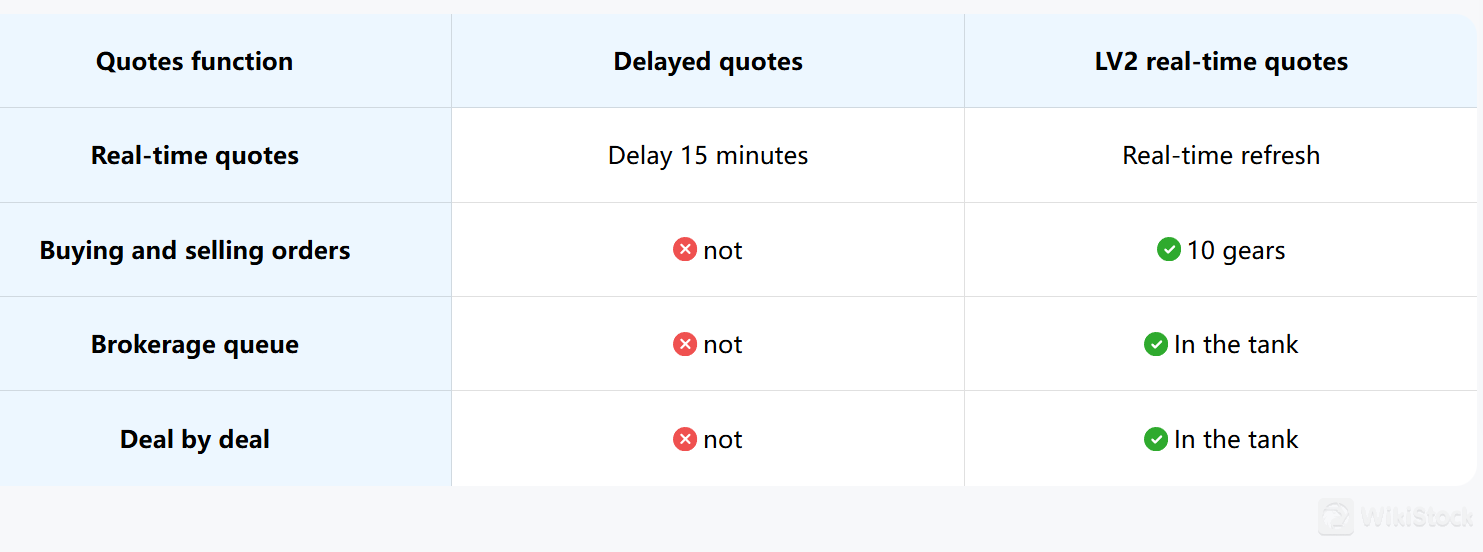

Real-Time Quotations: Zero2IPO offers real-time stock quotations for Hong Kong and U.S. stocks through their Quotes Mall, enhancing decision-making for traders.

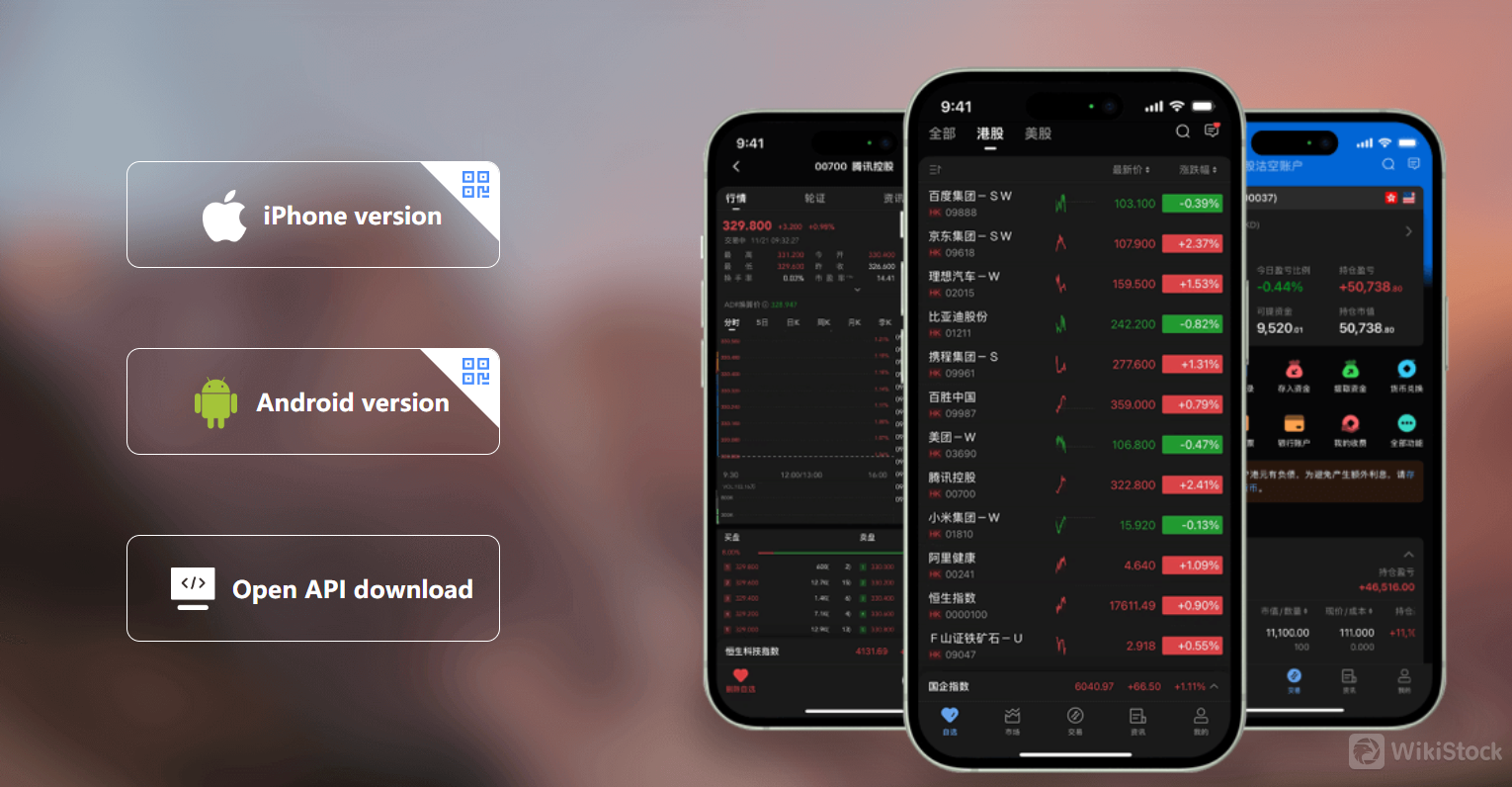

Mobile and API Access: The Zero2IPO App is available on multiple devices (iPhone, Android) and supports open API downloads, offering flexibility and convenience for clients.

Robust Customer Support: A robust customer support network is available through various channels, ensuring clients can get assistance when needed.

Cons

Limited Fee-Free Transactions: While deposit and withdrawal of funds through local Hong Kong banks are free, there is no mention of fees for international transactions, which could be a concern for global investors.

Higher Telephone Trading Fees: Commission fees for telephone trading (0.25%) are higher compared to electronic trading (0.15%), which may deter clients who prefer this method.

Platform Usage Fee: There is a platform usage fee of HK$10 per order, which, although currently waived, could be a deterrent once the promotion ends.

Is Zero2IPO International Safe?

Zero2IPO International is a regulated financial services provider operating under the oversight of the Securities and Futures Commission of Hongkong (SFC) in Hong Kong, holding license No. BNF723 and No. BRP688. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain the integrity of the financial market.

What are Securities to Trade with Zero2IPO International?

Zero2IPO International is a comprehensive financial services provider, offering a range of services tailored to meet diverse client needs. Their primary business operations encompass securities trading, investment banking, asset management, and structured finance, each designed to provide clients with robust financial solutions and strategic support.

Securities Business: Zero2IPO International's securities business provides clients with a seamless trading experience through its state-of-the-art platform. The Zero2IPO International Holdings Limited App, accessible on iPhone, Android, and through an open API, allows clients to trade Hong Kong and U.S. stocks with real-time quotations. This ensures that investors can make informed decisions and execute trades efficiently, benefiting from the convenience of mobile access and advanced trading tools.

Investment Banking: In the realm of investment banking, Zero2IPO International offers a comprehensive suite of services designed to support corporate finance needs. These include underwriting, mergers and acquisitions advisory, and capital raising. Their team of seasoned professionals delivers strategic advice and innovative solutions, helping clients navigate complex financial landscapes, optimize their capital structure, and achieve their growth objectives.

Asset Management: The asset management division of Zero2IPO International is dedicated to helping clients grow and preserve their wealth through tailored investment strategies. Leveraging a deep understanding of global markets and a disciplined investment approach, their asset management team offers a range of products, including mutual funds, private equity funds, and customized portfolio management services. This enables clients to achieve their financial goals with confidence, supported by expert guidance and a focus on long-term value creation.

Structured Finance: Zero2IPO International also excels in structured finance, providing innovative financial solutions that address complex financing needs. This includes structured products, securitization, and other bespoke financing arrangements. Their expertise in structuring and executing these transactions allows clients to optimize their financial resources, manage risks effectively, and access new sources of capital.

Zero2IPO International Fees Review

Commission Fees (Hong Kong Market):

Zero2IPO International offers competitive commission fees for trading in the Hong Kong market. For trades executed through electronic systems, the commission is set at 0.15% of the transaction amount, with a minimum fee of HK$100.

For those who prefer telephone trading, the commission rate is slightly higher at 0.25%, also with a minimum fee of HK$100. Similarly, trading in the grey market through electronic systems incurs a commission of 0.15% (minimum HK$100), while grey market trades executed via telephone attract a commission of 0.25% (minimum HK$100).

Platform Usage Fees (Hong Kong Market):

To facilitate a seamless trading experience, Zero2IPO International charges a platform usage fee of HK$10 per order. However, this fee is currently waived during the promotion period, providing clients with an added incentive to utilize the platform's robust trading capabilities.

Trading Market Fees (Hong Kong Market):

Trading on the Hong Kong market with Zero2IPO International involves several additional fees. The transaction fee is 0.00565% of the transaction amount, with a minimum charge of HK$0.01 per transaction.

There is also a Central Clearing Fee of 0.002% of the transaction amount, subject to a minimum of HK$2 and a maximum of HK$100. Additionally, a transaction levy of 0.0027% of the transaction amount (minimum HK$0.01) is applied. Stamp duty, calculated at 0.10% of the transaction amount (rounded up to the nearest dollar), is also charged, although this fee does not apply when trading warrants and CBBCs.

Furthermore, an AFRC Transaction Levy of 0.00015% of the transaction amount (minimum HK$0.01), effective from January 1, 2022, is included in the trading costs.

Deposit and Withdrawal of Funds (Hong Kong Market):

Zero2IPO International provides the convenience of free deposit and withdrawal services for funds transferred through Hong Kong local banks. This fee-free service ensures that clients can manage their finances efficiently without incurring additional costs for local bank transactions.

Zero2IPO International App Review

Zero2IPO International offers clients seamless access to its stock trading platform through the Zero2IPO International Holdings Limited App. This app is available on multiple devices, including iPhone and Android, and also supports open API download. This ensures that users can conveniently manage their investments and trade stocks from their preferred devices, enjoying the flexibility and ease of access to real-time market data and trading functionalities wherever they are.

Research & Education

Zero2IPO International offers Quotes Mall, a platform catering to investors interested in Hong Kong and U.S. stock markets by providing real-time quotations. This service enables users to access up-to-the-minute information on stock prices and market trends, empowering them to make informed investment decisions.

Customer Service

Zero2IPO International provides a comprehensive and accessible customer support network. Their support team can be reached through different channels for ultimate convenience.

Phone: 852-21878188

Email:enquiry@qkintl.com

Fax: 852-21290218

Address: Room 1506B, 15/F, International Commerce Centre, 1 Austin Road West, Kowloon, Hong Kong

Opening Hours: 9:00-18:00 (Weekdays)

Live chat

Conclusion

In summary, Zero2IPO International is a well-regulated financial services provider under the stringent oversight of the SFC. Offering a comprehensive range of services, including securities trading, investment banking, asset management, and structured finance, Zero2IPO caters to a diverse clientele with varying financial needs.

Despite some higher fees for telephone trading and additional market fees, the robust regulatory framework and comprehensive service offerings make Zero2IPO a reliable choice for investors seeking professional and secure financial services.

Now, the ball's in your court when it comes to choosing whether to go with this broker or explore other options. Hopefully, this review has shed some light on your decision-making process.

FAQs

Is Zero2IPO International suitable for beginners?

It is equipped with features and support systems that can make it suitable for beginners. Beginners can also benefit from utilizing the educational resources and customer support offered by Zero2IPO to enhance their understanding and confidence in trading and investing.

Is Zero2IPO International Safe?

It is a regulated financial services provider under the oversight of the Securities and Futures Commission of Hong Kong (SFC), holding licenses No. BNF723 and No. BRP688. This regulatory framework ensures that the company adheres to stringent standards designed to protect investors and maintain market integrity.

Is there a fee for depositing and withdrawing funds?

Depositing and withdrawing funds through Hong Kong local banks is free of charge.

What platforms does Zero2IPO support for trading?

Zero2IPO supports trading through its mobile app available on iPhone and Android devices, as well as through an open API for seamless integration with other systems.

Risk Warning

The information provided is based on WikiStock's expert evaluation of the brokerage's website data and is subject to change. Besides, online trading entails substantial risks, potentially leading to total loss of invested funds, so comprehending associated risks before engaging is crucial.

Others

Registered region

China Hong Kong

Years in Business

2-5 years

Products

Securities Lending Fully Paid、Futures、Investment Advisory Service、Stocks、ETFs、Mutual Funds

Relevant Enterprises

Countries

Company name

Associations

China Hong Kong

清科創業

Parent company

--

清科資產管理有限公司

Subsidiary

--

清科資本有限公司

Subsidiary

--

清科證券有限公司

Subsidiary

Download App

Review

No ratings

Recommended Brokerage FirmsMore

富士商品

Score

Victory Securities

Score

ABCI Securities

Score

Quam Securities

Score

競富

Score

Tianda Financial

Score

Gaoyu Securities

Score

華盛証券

Score

中順證券

Score

Waton Securities International

Score